An observation concerning recent history from economist Scott Sumner, placed here for the benefit of readers situated within yanking range of policy levers:

An observation concerning recent history from economist Scott Sumner, placed here for the benefit of readers situated within yanking range of policy levers:

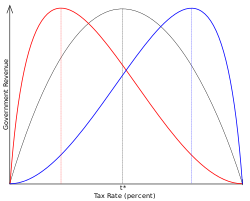

What has so amazed me about the worldwide supply-side revolution is the way that it has been dismissed by the left in the US, even the moderate left. The Reagan/Thatcher tax cuts were viewed as a sort of right wing plot to help the rich. I don’t know if liberals are even aware of the fact that all countries, including Sweden, were doing the same thing at the same time. This revolution would have occurred even if Reagan and Thatcher had never been elected. Rather they reflected a change in the intellectual atmosphere surrounding public policy formation. A change in what you might call the zeitgeist. Pragmatic policymakers all over the world (on both the left and right) looked at the evidence and reached a consensus that high [marginal] tax rates for the rich were counterproductive. That they didn’t meet the utilitarian criterion. (BTW, a similar worldwide change is now occurring vis-a-vis corporate marginal tax rates, and once again many American economists seem rather oblivious to what is going on elsewhere.)And who provided the intellectual ammunition for that policy revolution? It wasn’t economists at elite Ivy League schools, and it wasn’t even monetarists at the University of Chicago. In the late 1970s it was the supply-siders, of whom Arther Laffer was the most influential.

Sumner goes on to point out that Austan Goolsbee, an Obama economic advisor (well known to Canadians) who has been cast in the role of Great White Hope by various species of free-marketer, has been sounding an awful lot like someone who was in a coma over the last 25 years. (This palace-intrigue anecdote spotted by Tim Cavanaugh—"the government should not run a car company": no shit, guys—shows why Goolsbee has something of a popular following.)